Galp presents today its 4Q20 and FY20 results together with a short-term outlook for 2021.

“I am thrilled to be hosting my first results event as Galp’s CEO. Galp has been successfully investing for sustainable growth along the energy value chain, holding a high-quality asset base, with an enviable upstream and integrated gas portfolio, a solid downstream position supported on a strong brand, and already a robust renewables platform in place to support further growth. I am very excited to work with Galp’s people building a more efficient and cleaner integrated energy Company, thriving through the energy transition while ensuring a competitive value proposition to all stakeholders.” says Andy Brown, Galp’s CEO

Full year 2020 results

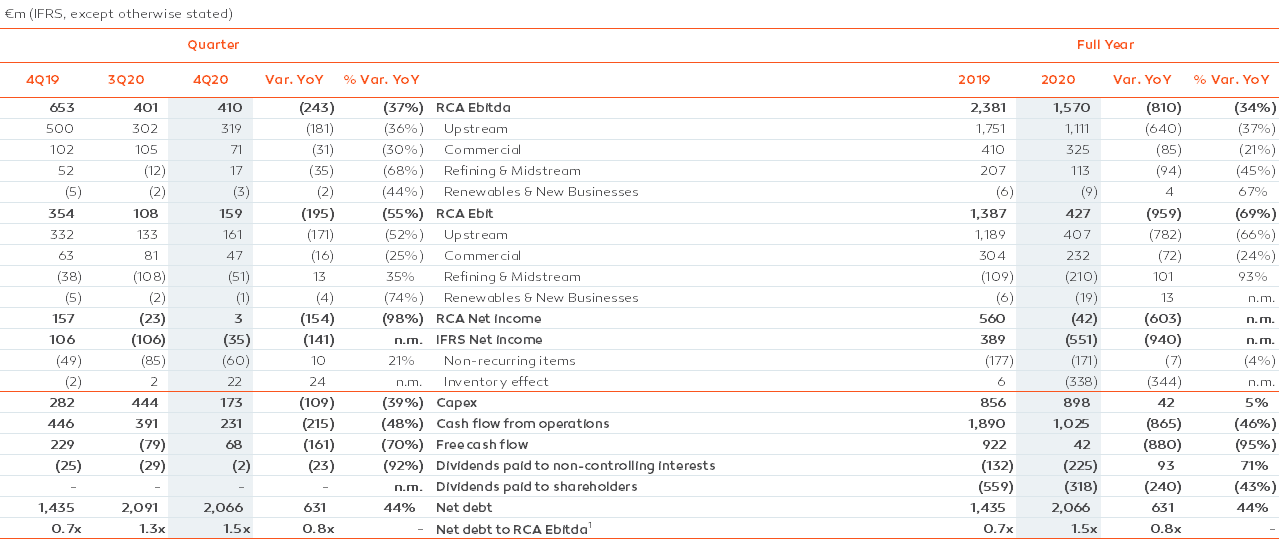

Cash flow from operations (CFFO) was €1,025 m, 46% lower YoY, while RCA Ebitda amounted to €1,570 m, 34% lower YoY, both reflecting the impact of the significantly weaker macro conditions resulting from the pandemic.

Net capex, considering the proceeds from the unitisation processes, stood at €830 m, including the €325 m payment for the solar PV acquisition made in 3Q20. Upstream accounted for 36% of total investments, whilst the downstream activities represented 23% and Renewables & New Businesses 39%.

Free cash flow (FCF) was €42 m, during one of the most challenging years for the industry and considering the relevant strategic acquisition executed in the renewables division.

Net debt increased to €2,066 m, considering the €544 m in dividends paid to shareholders and to minorities during the period, as well as €129 m of other effects, mostly related with impacts from the BRL and USD devaluations.

FCF would have been €410 m and net debt €1,698 m if considering the GGND sale agreement established in October, with the proceeds of €368 m expected to be received soon.

Fourth Quarter 2020 results

CFFO was down 48% YoY, to €231 m, reflecting the weaker market environment. FCF amounted to €68 m, while net debt at the end of the period was €2,066 m

RCA Ebitda of €410 m, with the following highlights:

- Upstream: RCA Ebitda was €319 m, down 36% YoY, following the decline in oil prices and lower production, as well as the USD depreciation against the Euro.

Working interest production was down 10% YoY to 122.8 kboepd, impacted by a concentration of planned maintenance activities and operational constraints, resulting primarily from the pandemic circumstances.

- Commercial: RCA Ebitda of €71 m, down 30% YoY, following the lower market demand and decline in oil products and natural gas sales.

- Refining & Midstream: RCA Ebitda was €17 m, a 68% decrease YoY, with the negative Refining performance reflecting the harsh refining margin environment, only partially offset by a resilient contribution from the Midstream segment.

- Renewables & New Businesses: The solar portfolio currently under production (Spain) is not consolidated in Group’s accounts, so it has no contribution to Ebitda.

RCA Ebit was down YoY to €159 m, mostly driven by the weaker operational performance.

RCA net income was €3 m. IFRS net income was -€35 m, with an inventory effect of €22 m and non-recurring items of -€60 m.

2021 Outlook

Galp revised its 2021 outlook incorporating additional layers of prudency given the uncertain macro circumstances and its potential effects on the Company’s operations and results. The key operational and financial guidance for 2021 is as follows:

| |

|

| |

2021 guidance |

| Macro |

| Brent ($/bbl) |

50 |

| Galp refining margin ($/boe) |

2 – 3 |

| Average exchange rate EUR:USD |

1.20 |

| Operational Indicators |

| WI production (kboepd) |

125 – 135 |

| Sines refining system crude utilisation (%) |

90 |

| Oil products sales to direct clients (mton) |

7.0 – 8.0 |

| NG and power sales to direct clients (TWh) |

26 – 27 |

| Renewable generation @100% (TWh) |

1.1 – 1.4 |

| Financial Indicators |

| RCA Ebitda (€ bn) |

1.6 – 1.8 |

| CFFO (€ bn) |

1.3 – 1.5 |

| Net capex1 (€ bn) |

0.5 – 0.7 |

1Considers divestments, such as the €368 m proceeds from GGND stake sale, expected to be received in 1Q21.

Shareholder dividend proposal

The Board of Directors will propose at the Annual General Meeting in April, a dividend per share (DPS) of €0.35/share, related to the 2020 fiscal year, to be paid in May. The dividend cut reflects the impacts from unexpected and unprecedented market conditions.

The Board also indicated a DPS target of €0.50/share related to the 2021 fiscal year, considering the foreseen macro scenario.