Powers and Operation

Powers

The Executive Committee is responsible for the day-to-day management of the Company in line with the strategic guidelines defined by the Board of Directors and the powers delegated also by the Board of Directors, that can be consulted here.

In order to ensure effective and efficient monitoring by the non-executive members of the activity of the Executive Committee and to facilitate the related duty to inform, a range of mechanisms were adopted. The calls and minutes of the meetings of the Executive Committee are made available to the Chairman of the Board of Directors and to the Chairman of the Audit Board.

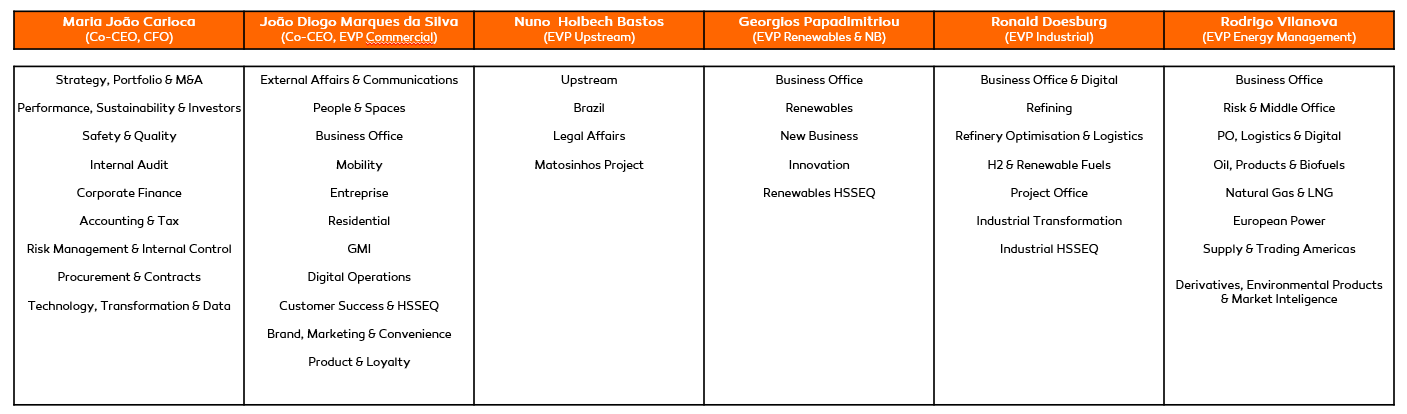

Notwithstanding the collective exercise of the Executive Committee´s powers, a functional allocation, among the members of the Executive Committee, of areas of action in respect of the business and activities of the Company and of its controlled or subsidiary companies, was approved.

Operation

Pursuant to the Regulations of the Board of Directors, the Executive Committee shall approve, at the beginning of each term, the rules that define the principles and rules of the organization and its operation, which can be found here.

In accordance with the Regulations of the Executive Committee, the Executive Committee must meet once a week and meets validly if the majority of its members are present. The respective decisions are made with the votes of the majority of directors attending.

In 2024, the Executive Committee held 25 meetings and deliberated three through votes cast by electronic communications.