Galp presents today a strategy update together with its third quarter 2019 results.

“Galp is looking into the future with confidence. We are positioning the Company for its next growth cycle and for the future of energy. Galp is actively involved in the energy transition towards a lower carbon world, working on energy solutions that can be economical and environmentally sustainable, and committed to a stringent social responsible attitude. The Company’s ongoing projects will support a selective portfolio development, focused on increasing long-term growth and resilience, while maintaining a strong financial discipline and commitment to shareholder returns.” says Carlos Gomes da Silva, Galp’s Chief Executive Officer.

Investing in sustainable growth across the energy value chain

Galp’s main ambition is to continue strengthening the resilience of its current and future portfolio by continuously extracting value from it and by investing in projects that allow attractive returns under several strategic scenarios.

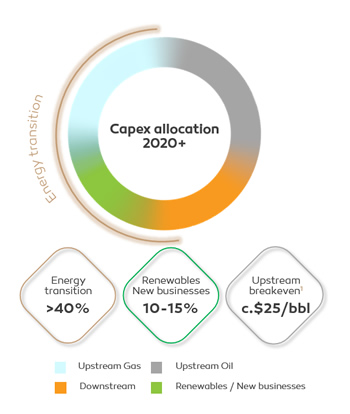

Over 40% of our long-term investments are aimed at capturing opportunities within the energy transition context. This includes increasing the weight of natural gas in our production mix and developing a competitive renewable power generation business.

The Company’s upstream investments remain focused on developing its world-class projects, with average portfolio breakeven standing at c.$25/bbl1. We will also continue to further optimise costs and increase recovery factors.

On the downstream, Galp intends to optimise and reinforce its refining and commercial asset base and selectively exploring new value enhancing opportunities to increase the portfolio’s competitiveness.

1 NPV10 Brent breakeven

Net investments are expected to average €1.0 bn to €1.2 bn per year until 2022, including both organic and additional projects’ equity requirements, which will target the development of high-quality growth projects in the years to come.

Adding value while maintaining a strong balance sheet

The Company intends to continue relying on a robust financial position, and portfolio management when required, to fulfil the needs for further value enhancement.

All capital allocation moves will comply with our internal commitment to stay below 2x Net Debt to Ebitda, while aiming a c.15% ROACE for the Group during the next decade.

Progressive dividend policy

Considering the current cycle of the Company, Galp’s management is targeting a dividend per share increase of 10% per year over the next three years (2019-21).

This dividend increase reiterates Galp’s confidence on its financial plan and the commitment to balance high quality investments focused on long-term value creation with growth in shareholder distributions.