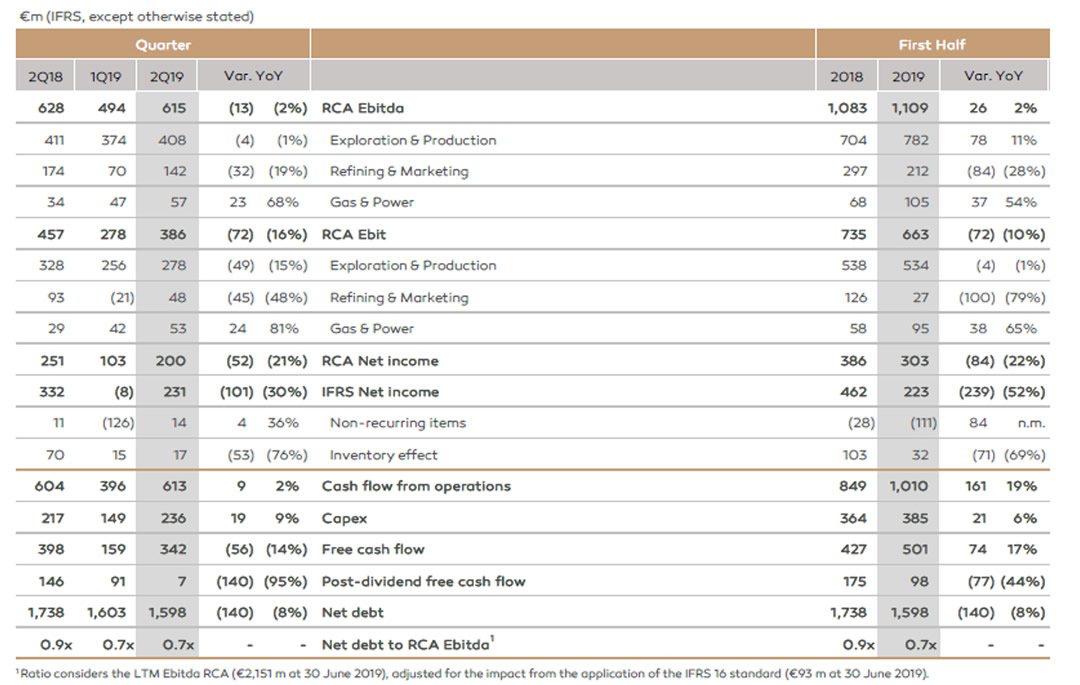

Galp’s first-half 2019 results once again benefited from the company’s integrated profile, as increased earnings at the Exploration and Production (E&P) unit, as well as in Gas and Power (G&P) offset a decline in Refining and Marketing (R&P), dented by tighter European refining margins and operational constraints.

Earnings before interest, taxes, depreciation and amortization adjusted for extraordinary items (Ebitda RCA) in the first six months of 2019 totaled €1.1 billion, a 2% increase from the same period a year earlier, with 82% originating in the international markets.

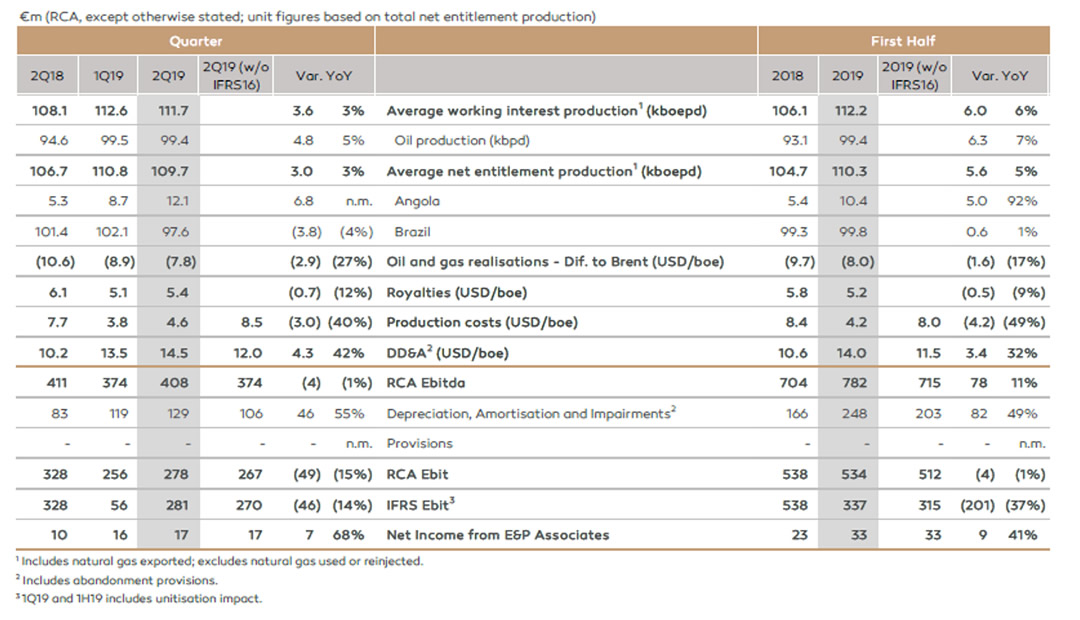

E&P Ebitda increased 11% from the same period a year ago, to €782 million, on the back of 5% increase in net entitlement oil and natural gas production. This stood at an average 110.3 thousand barrels per day (kboepd) in the six months, boosted by increased production in Angola, where two FPSO-type floating production units entered service in July of 2018 and in April this year.

Production in Brazil was stable, with the ramp-up of the two most-recent FPSOs offsetting the effects of the dilution of Galp’s stake in the Lula field, after its unitization, as well as that of maintenance activities in three other FPSOs. Total working interest production rose 6% to 112.2 kboepd.

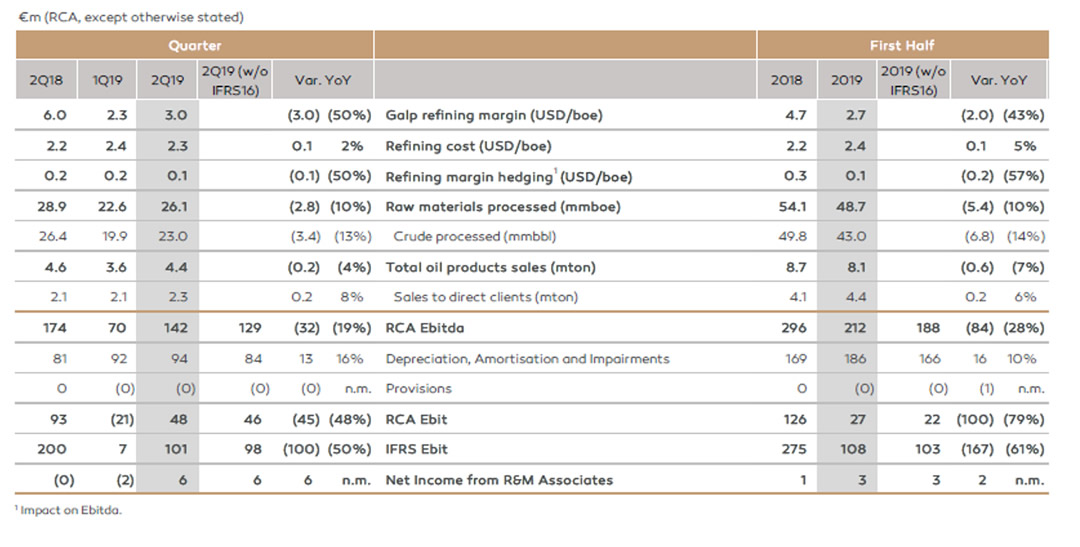

Operational earnings at the R&M unit dropped 28% to €212 million, reflecting a decline in European refining margins, as well as operational constraints that limited the volumes of processed raw-materials and, thus, also the availability of oil products for sale, namely on the international markets.

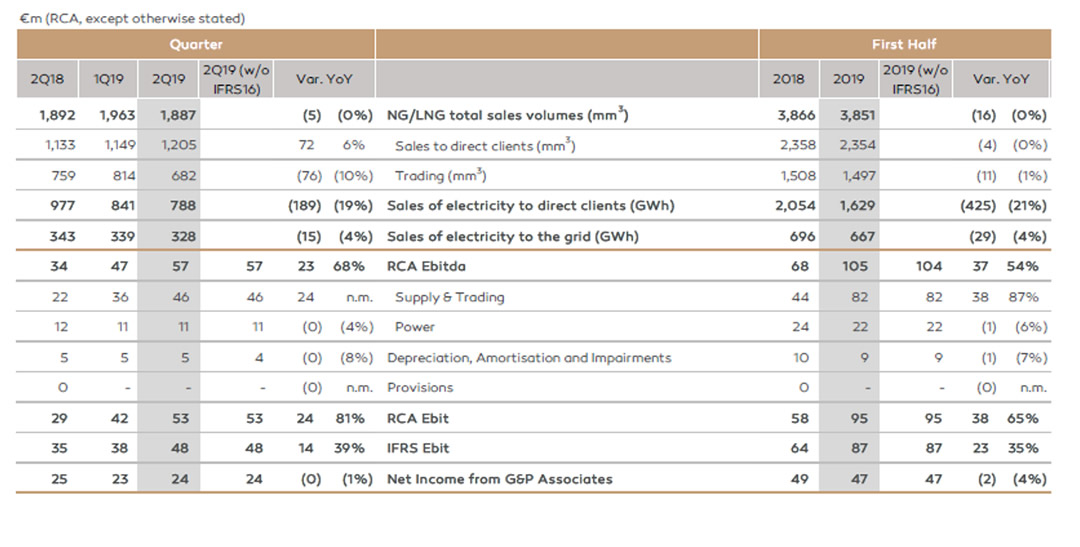

Ebitda at the G&P unit rose 54%, to €105 million, supported by a higher contribution from sales of natural gas and electricity, and also benefitting from network trading in the European natural gas hubs.

Adjusted net income for the first half totaled €303 million, a 23% decline from the same period of 2018. Non-recurring items, including the effects of the Lula field unitization process, totaled €111 million. Galp’s economic position in this block, held through its subsidiary Petrogal Brasil, has declined from 10% to 9,2%, effective on April 1, 2019.

Other financial indicators

Cash flow from operations in the first quarter totaled €1.01 billion, in spite of a lower contribution from refining. Free cash flow generated in the semester was €501 million, or €98 million after dividends to shareholders and minorities.

Capex in the first half rose 6% to €385 million, of which 80% were allocated to the E&P businesses, including the payment for the acquisition of an additional stake in the BM-S-8 that brought Galp’s stake to 20%, and works in the North of Carcará area. Investments in downstream were mainly focused on the improvement of refining energy efficiency.

On June 30, net debt was €1.6 billion, down €140 million from year-end 2018. Net debt to Ebitda RCA is 0.7x.

Results by business area

Exploration & Production

Refining & Marketing

Gas & Power

Gas & Power

Financial data

Financial data