All the materials related with the results and the short-term outlook, including the video presentation from Galp’s executives, are available here. Galp’s analyst Q&A session will be held at 14h (Portugal / U.K. time). Additional details below.

“During the second quarter, Galp’s strong performance across all business segments supported a robust set of results. Our FCF reached €488 m, despite the higher cyclical working capital build from the increased commodity price environment. This allowed us to reinforce our financial position, with our Net Debt/Ebitda ratio now standing at 0.7x.

We made good progress in the execution of key projects that underpin our portfolio reshaping. The macroeconomic environment remains extremely volatile, but we are well positioned, both in our established businesses and on the low carbon front, to deliver on our investment proposition.”

Andy Brown, CEO

Second quarter 2022

Galp’s 2Q22 results reflect a robust operational performance, with the Company successfully capturing the favourable market conditions, namely in the Upstream, Refining and Renewables activities. RCA Ebitda reached €1,244 m:

- Upstream: RCA Ebitda was strong at €878 m, reflecting increased oil and gas realisations, which benefited from the favourable macro environment. Working Interest (WI) production decreased 7% YoY reflecting a higher concentration of maintenance activities in the period.

- Commercial: RCA Ebitda was €97 m, supported by a gradual recovery on the demand of oil products, as well as a stronger performance from the B2B segment, namely on aviation and marine bunkers activities.

- Industrial & Energy Management: RCA Ebitda was €283 m, with a robust contribution from the refining activities, partially offset by a negative lag in supply oil pricing formulas and persistent natural gas sourcing restrictions.

- Renewables & New Businesses: no relevant RCA Ebitda as most of the operations are not consolidated. The pro-forma Ebitda1 of the Renewables operations reached €62 m in the period, reflecting increased generation from added capacity and higher availability, as well as stronger solar power prices in Iberia.

RCA net income was €265 m, also reflecting €-331 m in mark-to-market swings on Brent and refining margin hedges (c.€-230 m post-tax) related to the entire 1H22 (in 1Q22 booked as a special item).

The strong operational performance led Galp’s adjusted operating cash flow (OCF) to €964 m. CFFO reached €747 m, including a working capital build resulting from the increased commodities prices during the period although partially offset by a €199 m roll off in natural gas derivatives exposure.

FCF was positive at €488 m. Net debt decreased €207 m, considering €247 m spending in shareholder distributions, of which €207 m in dividends and €40 m in the share buyback programme in place since May.

1 Pro-forma considers all Renewables projects as if they were consolidated according to Galp’s equity stakes

First half 2022

Galp’s RCA Ebitda was €2,114 m, while OCF was €1,603 m.

Net Capex totalled €365 m, mostly directed towards Upstream’s developments and Renewables’s portfolio execution.

FCF amounted to €517 m, with the strong cash generation supported by operational performance being partially offset by a working capital outflow.

Considering distributions of €247 m (cash dividends and buybacks) and dividends to non-controlling interests of €111 m, as well as other adjustments, net debt decreased €173 m, compared to the end of last year.

At the end of the period, net debt amounted to €2,185 m and net debt to RCA Ebitda was at 0.7x.

Note: Adjusted operating cash flow (OCF) indicator represents a proxy of Galp’s operational performance excluding inventory effects, working capital changes and special items. The reconciliation of this indicator with CFFO using IFRS is in chapter 6.3 Cash Flow of the report. Pro-forma considers all Renewables projects as if they were consolidated according to Galp’s equity stakes.

Short term outlook

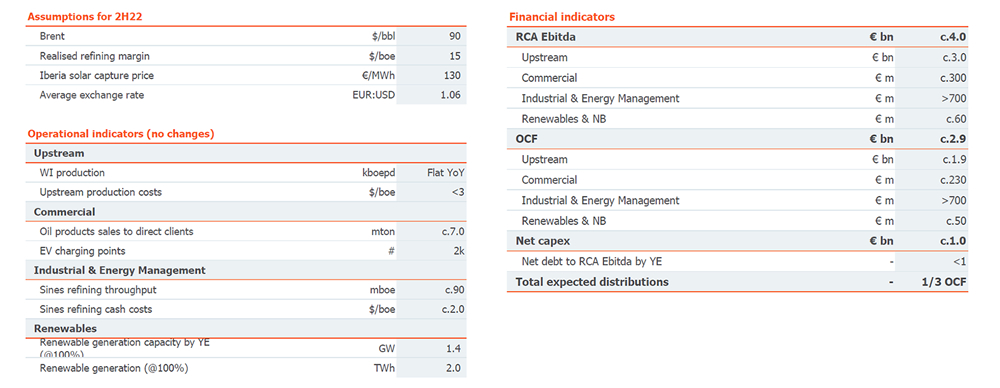

Galp is adjusting its key financial guidance for 2022 to reflect the 1H22 performance and a revised macro-outlook for the remaining of the year. The operational guidance remains unchanged.