Galp's earnings in the nine months through the end of September remained stable compared with the same period of 2018, as an increase in the production of oil and natural gas, as well as gas and electricity marketing activities, offset the effects of a challenging macro context and the impact of operating restrictions on Galp's refining system.

Adjusted earnings before interest, taxes, depreciation and amortization (Ebitda RCA) at the end of September totaled €1.73 billion, or €3 million more than in the same period a year before. More than 85% of Galp’s Ebitda originated in international markets.

Exploration & Production (E&P) Ebitda rose by €151 million, supported by an 11% increase in oil and gas production, to which operations in both Brazil and Angola contributed positively, offsetting the 10% average drop in Brent price, somewhat dampened by the dollar’s appreciation against the euro.

Production benefitted from the ramp-up of the most recent units that started producing in the Lula field, in Brazil, as well as the unit allocated to Block 32’s Kaombo South project, in Angola. An additional unit, the first one in Brazil’s Iara field, is already on location and expected to start producing before year-end.

The E&P unit has contributed to balance Galp’s operational results at a period in which Galp’s refining system operated with constraints, particularly during the third quarter, namely with the implementation of energy efficiency projects and programmed maintenance works. The drop in refining margins, from $5.1 to $3 per barrel, also contributed to a drop in Refining and Marketing operational earnings in the first nine months of 2019 from a year earlier to €317 million.

Galp’s refining system is currently operating in full, ready to face the challenges ahead, namely the supply of IMO-compliant low-sulphur marine fuel oil.

Gas and Power’s contribution to the company’s nine-month earnings was also positive, with the area’s Ebitda totaling €141 million, 27% more than in the same period of a year before, reflecting improved conditions in the Iberian market.

Financial indicators

Adjusted net income (RCA) in the first nine months of 2019 declined 33% from a year earlier, to €403 million. Non-recurring events totaling €128 million include the impact of recent unitization processes in Brazil. Net income by international accounting standards, known as IFRS, was €283 million.

Nine-month Capex marginally declined to €573 million when compared with the same period of 2018, with 73% allocated to E&P projects. Downstream Capex focused mainly on energy efficiency improvements in the refineries, as well as on maintenance works.

As of September 30, net debt stood at €1.645 billion, €92 million below year-end, reflecting the company’s positive cash generation during the three quarters. Net debt to Ebitda is 0.8x.

Strategy: €400 million for the energy transition

Galp has also put forth a strategy update for the upcoming years, strengthening the amounts available to advance projects that will promote a smooth transition to a lower carbon intensive energy model.

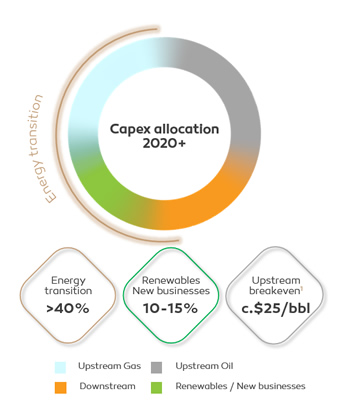

In practical terms, net investments are expected to average €1.0 billion to €1.2 billion per year until 2022, of which more than 40% are aimed at capturing opportunities within the energy transition context. This includes increasing the weight of natural gas in the company’s production mix and developing a competitive renewable power generation business.

In practical terms, net investments are expected to average €1.0 billion to €1.2 billion per year until 2022, of which more than 40% are aimed at capturing opportunities within the energy transition context. This includes increasing the weight of natural gas in the company’s production mix and developing a competitive renewable power generation business.

“We are preparing Galp for a new growth cycle in which we will contribute very actively to the energy transition,” said Chief Executive Officer Carlos Gomes da Silva. “We will promote economically and environmentally sustainable solutions, maintaining, as always, the commitment towards acting in a socially responsible manner that will not cease to ensure the company’s long-term growth, its financial discipline and shareholder return,” he added.

Average capital spending in renewable energy and in new business models is likely to represent between 10% and 15% of total capex allocation.

The company’s upstream investments remain focused in the development of its high-potential world-class projects, with the portfolio’s average breakeven standing at around $25 per barrel. The current Capex commitment covers both the development of Galp’s current projects as well as others that may arise and bring in high-quality growth in years to come.

On the downstream, Galp intends to optimise and reinforce its refining and commercial asset base and selectively exploring new value enhancing opportunities to increase the portfolio’s competitiveness.

All capital allocation moves will comply with a commitment to remain below 2x Net Debt to Ebitda, while aiming a 15% ROACE for the Group during the next decade.

Progressive dividend policy

Considering the current cycle of the company, Galp’s management is targeting a dividend per share increase of 10% per year over the next three years (2019-21). This dividend increase reiterates Galp’s confidence on its financial plan and the commitment to balance high quality investments focused on long-term value creation with growth in shareholder distributions.