Galp has agreed with the ACS Group the acquisition of solar photovoltaic (PV) projects in Spain comprising a total generation capacity of c.2.9 GW.

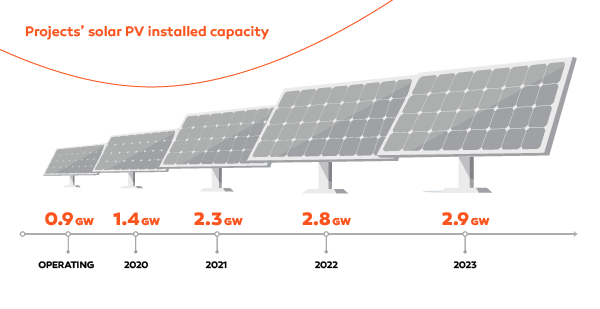

The agreement includes over 900 MW of power generation capacity recently commissioned and a pipeline of projects at different stages of development to be installed until 2023. All projects have secured the respective access to the grid permit.

The portfolio incorporates a selection of high-quality projects, with attractive returns, which support Galp’s strategic ambitions and places the Company as the leading solar PV player in Iberia.

The transaction, which includes the acquisition, development and construction of the projects, has a total value of c.€2.2 bn up to 2023. Completion of the transaction, which is subject to certain usual conditions, is expected during 2Q20, with c.€450 m to be paid at closing and c.€430 m of project finance debt to be assumed.

Galp intends to project finance all the remaining 2020-23 developments and foresees opportunities to bring a potential partner to its renewables ventures. The Group net investment during the 2020-22 period is expected to remain on average at €1.0 – 1.2 bn per annum, also considering potential divestments.

Carlos Gomes da Silva, Galp CEO

“This deal will strengthen Galp’s position as an integrated energy player and represents a significant step towards our commitment to support a gradual transition into a lower carbon economy. It reflects a disciplined decision, aligned with the Company’s strategic and capital allocation guidelines, which consider 10% to 15% of future investments allocated to the development of a competitive renewable and new businesses portfolio.”

Susana Quintana-Plaza, Galp COO Renewables & New Business

“We are very pleased to reach this agreement with the ACS Group for an acquisition that will allow us to integrate and develop, with a global leader on project development, a high-quality solar portfolio leveraging Galp’s relevant presence in Iberia as an energy player and accelerating the Company’s growth across the power space.”

Citigroup Global Markets and King & Wood Mallesons acted as financial and legal advisors, respectively.